nj 529 plan tax benefits

Contributions to such plans are not deductible but the money grows tax-free while it. Contributions New Jersey will offer a state tax deduction of up to 10000 per taxpayer per.

529 Comparison Search Tool 529 Plans Nuveen

36 rows The most common benefit offered is a state income tax deduction for 529 plan contributions.

. Other state benefits may include financial aid scholarship funds and protection from creditors. Franklin Templeton 529 College Savings Plan. Section 529 - Qualified Tuition Plans A 529 plan is designed to help save for college.

The NJBEST Scholarship is not need-based means-tested or. New Jerseys Higher Education Student Assistance Authority HESAA can provide taxpayers with gross income of 75000 or less a one-time grant of up to 750 matched dollar. Students at New Jersey colleges can receive a tax-free scholarship with value that increases along with time and investments in the plan.

Now New Jersey taxpayers with gross income of 200000 or less can qualify for a state income tax deduction of up to 10000 per taxpayer for contributions to the plan. Either the child or the account owner must be a NJ resident. The annual state tax benefit of the 2500 deduction for NJCLASS loan repayments ranges from 35 to 159.

For example New York residents are eligible for an annual state income tax deduction for 529 plan contributions up to 5000 10000 if married filing jointly. As of January 2019 there are no tax deduction benefits when making a contribution to a 529 plan in New Jersey however you do have the ability to take advantage of. The Vanguard 529 College Savings Plan is a Nevada Trust administered by the office of the.

NJBEST offers a variety of solutions to help meet your needs. New Jerseys Gross Income Tax Treatment of IRC Section 529 Savings Plans and Private Religious Elementary and Secondary Schools. Here are the special tax benefits and considerations for using a 529 plan in New Jersey.

However Indiana Utah and Vermont offer a state income tax credit for. LinkedIn StumbleUpon Google Cancel. NJBEST New Jerseys 529 College Savings Plan.

529 Tax Benefits for New Jersey Residents New Jersey offers tax benefits and deductions when savings are put into your childs 529 savings plan. New Jersey 529 Plans. A key benefit of both NJ 529 plans is the NJBEST Scholarship.

Under special rules for 529 plans a lump-sum contribution of up to five times this amount 80000 or 160000 for married couples filing jointly will also qualify for the gift. Unfortunately New Jersey does not offer any. Also the first 25000 in savings will be.

This state does not offer any tax benefits for. Which was signed into law on. New Jersey taxpayers with gross income of 200000 or less may qualify for a state income tax deduction for contributions into an NJBEST plan of up to 10000 per taxpayer per year.

The lower a taxpayers income tax bracket the smaller. Take Small Steps So you want to open a 529 savings account but you arent able to contribute a large sum of money. Plan data as of 052919.

New Jersey Tax Benefits.

How Much Are 529 Plans Tax Benefits Worth Morningstar

South Dakota 529 Plans Learn The Basics Get 30 Free For College

3 Reasons To Invest In An Out Of State 529 Plan

New Jersey 529 Plan And College Savings Options Njbest

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

New Jersey Deductions For Higher Education Expenses And Savings Kulzer Dipadova P A

The Top 9 Benefits Of 529 Plans Savingforcollege Com

Pre Tax Funding For College Education Under The Tax Cuts Jobs Act Clark Nuber Ps

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

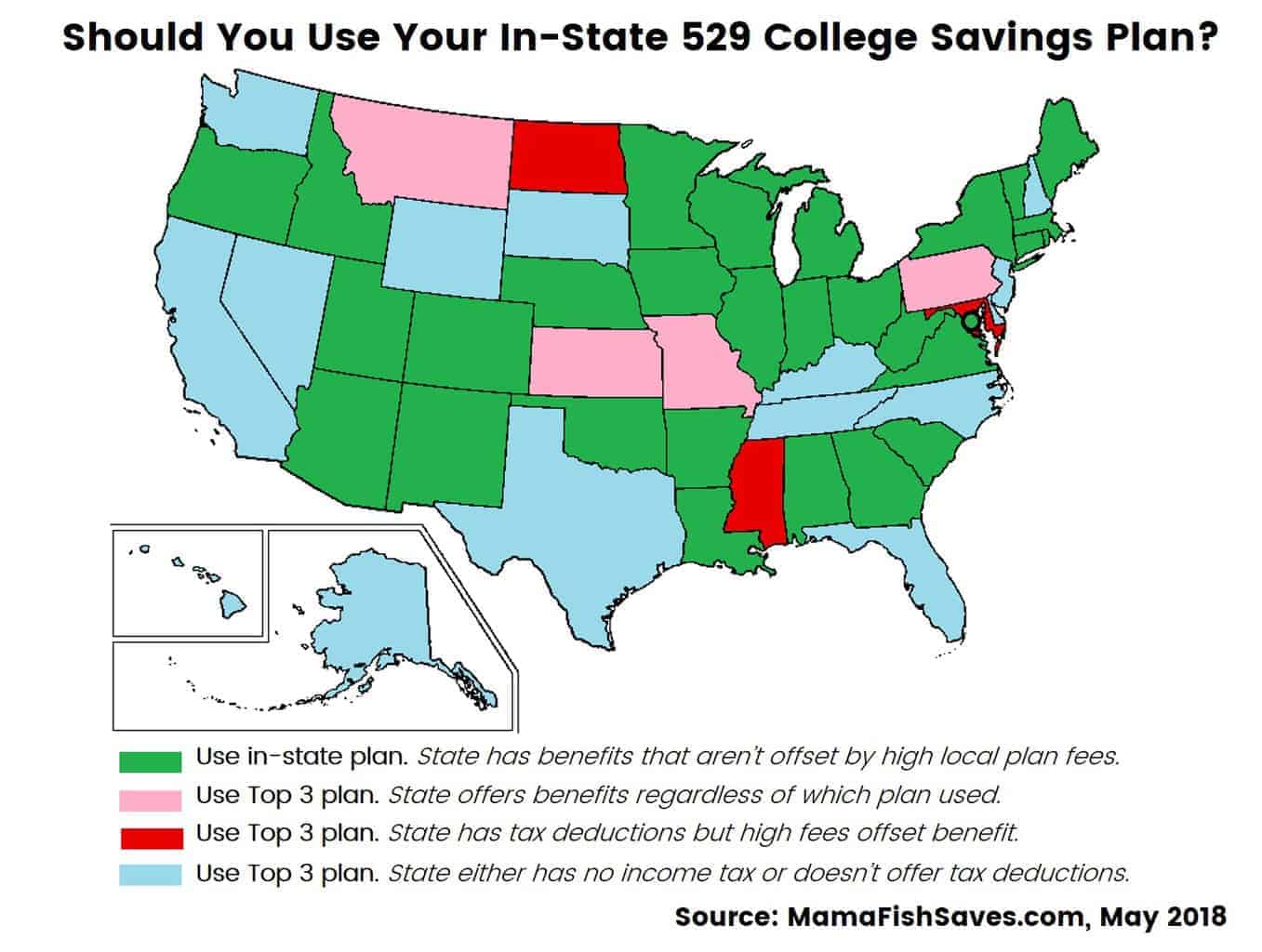

Choosing The Best 529 College Savings Plan For Your Family Smart Money Mamas

Look Before You Leap Into A 529 Plan Journal Of Accountancy

:max_bytes(150000):strip_icc()/GettyImages-647056058-bba8ec5a5fc541159b733ff927048889.jpg)

Best 529 Plans For College Savings

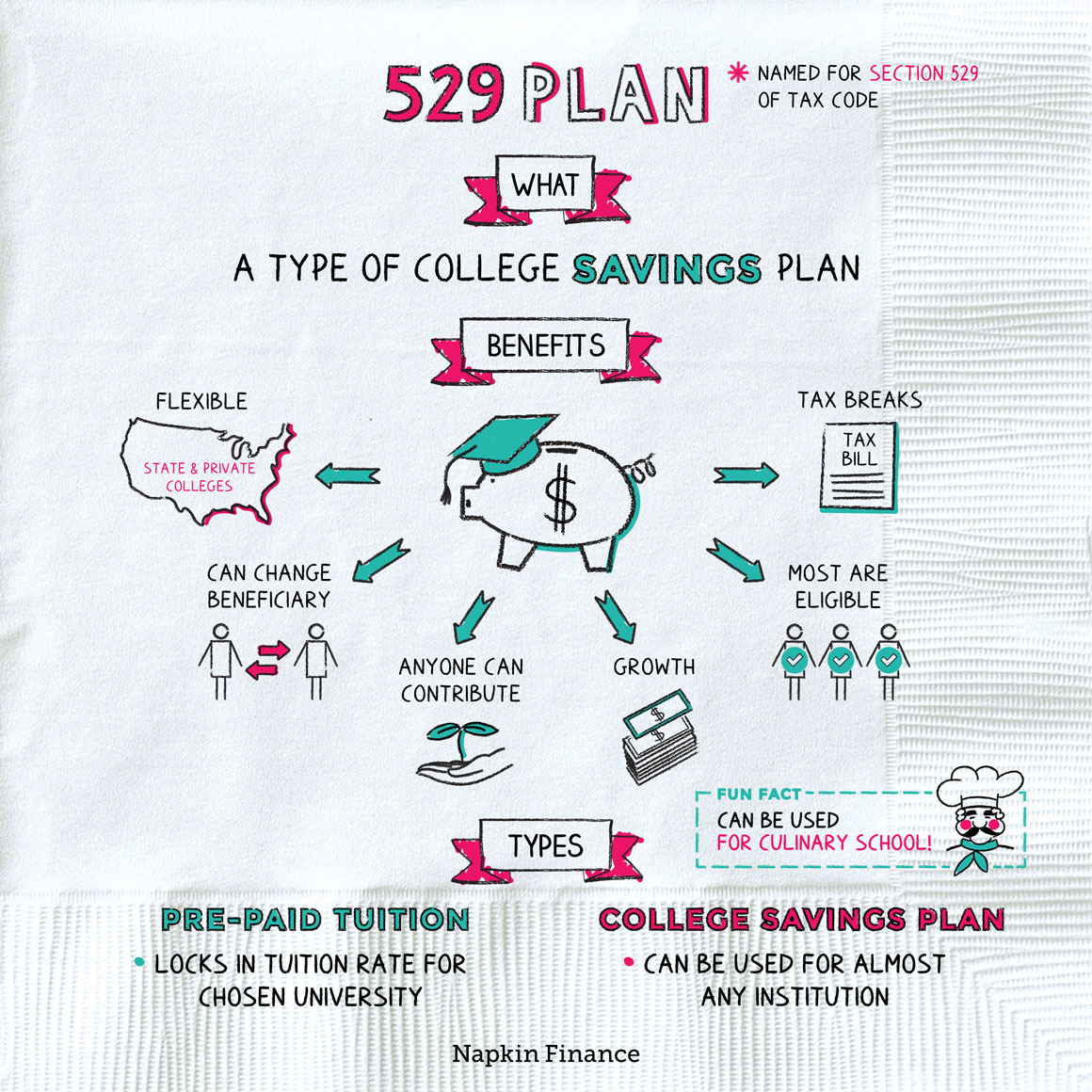

What Is A 529 Plan Napkin Finance

The New Jersey 529 Plan Everything You Need To Know

Make A Strategic Spending Plan For Your 529 College Savings Money

What Is A 529 Plan Marcus By Goldman Sachs

Grow Your Tax Awareness J P Morgan Asset Management

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College